The Connected Banking Summit is a series of events that aim to bring together the key players and stakeholders in the banking industry to discuss and explore the latest trends, challenges, and opportunities in the digital era. The summit focuses on how banks can leverage integrated solutions and cutting-edge technologies to enhance their customer experience, security, privacy, and regulatory compliance, as well as to foster innovation and collaboration. The summit also showcases the best practices and success stories of the banking industry in Africa and beyond, highlighting the potential and impact of the digital economy, DeFi, eCedi, AI, ML, and other emerging technologies. The 9th Edition of the Connected Banking Summit, taking place on February 21st, 2024, in Accra, Ghana, is the premier event for the banking industry in West Africa, featuring esteemed global executives, experts, and leaders from various sectors and domains. The summit is a unique opportunity to network, learn, and exchange ideas with the industry leaders and peers, and to shape the future of banking in West Africa and beyond.

What customer experience enhancement models are and why they are important for the banking industry

Customer experience enhancement models are frameworks or methods that help banks design and deliver better experiences for their customers across different channels and touchpoints. They typically involve understanding customer needs, expectations, and preferences, mapping customer journeys, identifying pain points and opportunities, designing and testing solutions, measuring and improving outcomes, and fostering a customer-centric culture.

Customer experience enhancement models are important for the banking industry because they can help banks achieve various benefits, such as:

- Increasing customer satisfaction, loyalty, and advocacy, which can lead to higher retention, cross-selling, and referrals.

- Reducing costs and inefficiencies, by streamlining processes, eliminating errors, and optimizing resources.

- Enhancing revenue and profitability, by attracting new customers, increasing market share, and creating differentiation.

- Improving compliance and risk management, by ensuring customer data protection, privacy, and security, and meeting regulatory standards.

- Driving innovation and transformation, by leveraging new technologies, data, and analytics, and collaborating with partners and stakeholders.

Customer experience enhancement models are one of the pivotal topics that will be covered at the Connected Banking Summit 2024, where you can learn from the best practices and success stories of the banking industry in Africa and beyond. Don’t miss this opportunity to join the conversation and shape the future of banking. Register now and secure your spot at the Connected Banking Summit 2024.

Some of the speakers at the summit are:

- Dr. Maxwell Opoku-Afari, First Deputy Governor, Bank of Ghana, who will deliver the keynote address on “The Future of Banking in West Africa: Challenges and Opportunities”

- Victor Yaw Asante, Managing Director, FBN Bank Ghana, who will moderate the panel discussion on “Customer Experience Enhancement Models: How to Deliver Seamless and Personalized Experiences Across Channels and Touchpoints”

- Abena Amoah, Managing Director, Ghana Stock Exchange, who will participate in the panel discussion on “Customer Experience Enhancement Models: How to Deliver Seamless and Personalized Experiences Across Channels and Touchpoints”

- Neo Gong, Director of Digital Banking Solutions, Huawei, who will present a case study on “How Huawei Empowers Banks to Enhance Customer Experience with AI and Cloud Technologies”

- George Njuguna, Chief Information Officer, Safaricom PLC, who will share his insights on “How Safaricom Leverages M-Pesa to Enhance Customer Experience and Financial Inclusion in Kenya”

- Sahil Arya, Head of Digital Banking, Gulf African Bank, who will join the fireside chat on “How to Build a Customer-Centric Culture and Strategy in the Banking Industry”

- Moses Ndirangu, Director of Innovation and Technology, Equity Bank Kenya Ltd, who will join the fireside chat on “How to Build a Customer-Centric Culture and Strategy in the Banking Industry”

- Ashish Baghel, Chief Digital Officer, Prime Bank Africa, who will lead the workshop on “How to Design and Implement Customer Journey Maps for the Banking Industry”

Digital Access and Identity Management

Discover important subjects like Digital Inclusion and Transformation, Customer Experience Enhancement Models, Africa’s Thriving Digital Economy, Modernising and Shaping Banks of the Future, the Role of AI and ML Empowered by Data and Analytics, Collaborative Partnerships in Payments, ESG and Sustainability, Digital Access and Identity Management, and the Dynamic Synergy between Traditional FIs and FinTechs.

Take part in thought-provoking talks facilitated by well-known speakers to get a unique edge over competitors using the most recent thinking. This summit provides an unrivalled chance to meet with professionals in the field in person, promoting networking and providing insights into the most recent developments in the telecom business.

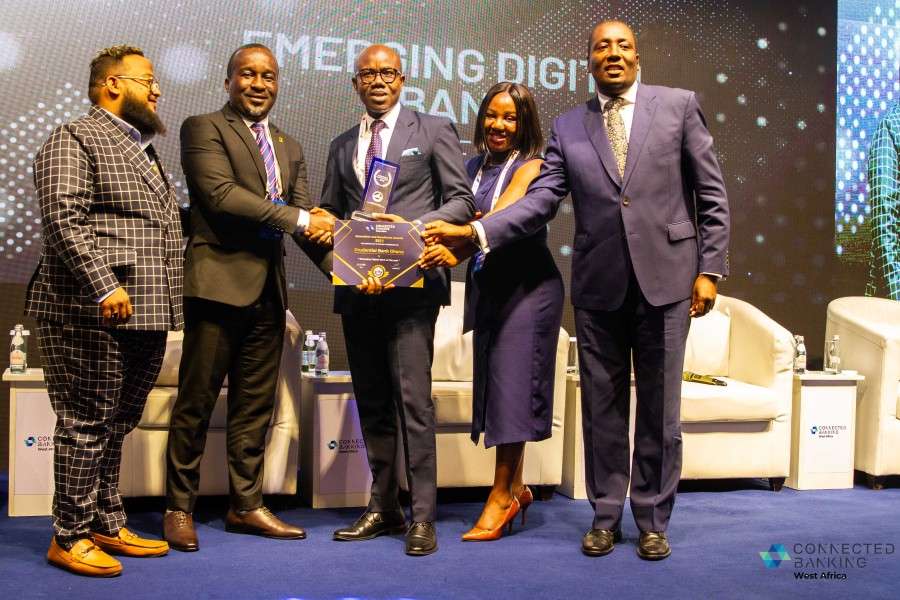

Please visit the Connected Banking Summit – Innovation & Excellence Awards 2024 (formerly Digital Banking Summit) (connected-banking.com)