Payoneer is a global payments platform that partners with Freelancers, SMBs, marketplaces and enterprises to solve their biggest payment challenges. Payoneer offers a range of services that make it easier for freelancers in Africa to get paid.

Ways Payoneer is helping Freelancers in Africa

- Get paid easily & secure: Payoneer allows freelancers to receive payments from clients in over 150 countries, with multiple payment options. This means that freelancers can receive payments from clients all over the world without worrying about currency conversion or international transaction fees.

- Get paid as a local: With Payoneer, freelancers can receive payments in USD, EUR, GBP and more to their receiving accounts in America, Europe and Asia, without opening local bank accounts. This makes it easier for freelancers to receive payments from clients all over the world.

- Easily access your funds: Freelancers can withdraw their funds to their local bank account or ATM, spend online or instore, and send global payments at low fees. This means that freelancers can easily access their funds and use them as they see fit.

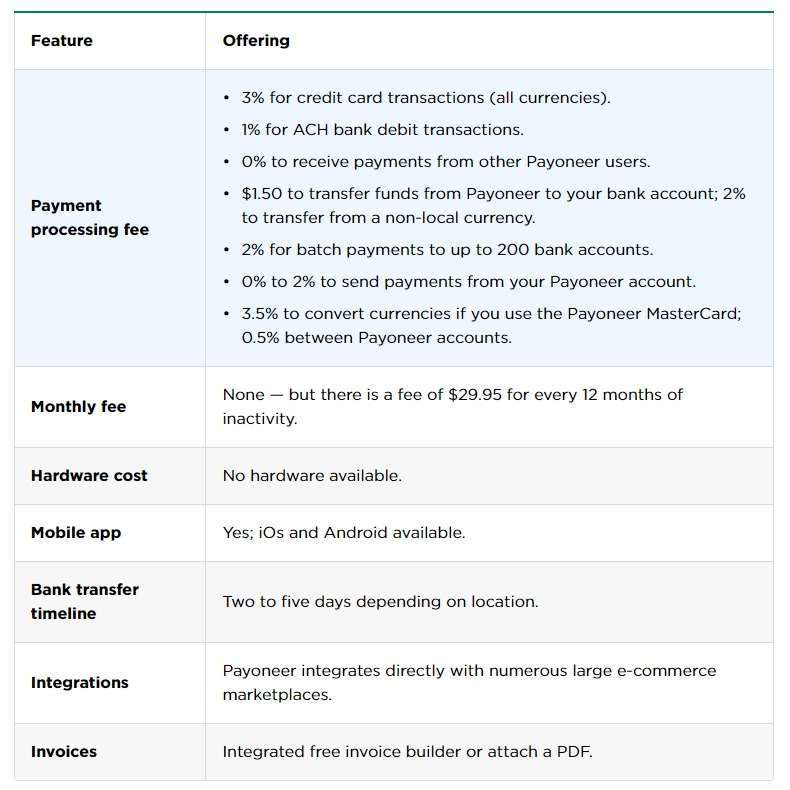

What are the fees for using Payoneer?

Payoneer charges a fee for each transaction, which varies depending on the type of transaction and the countries involved . Here are some of the fees that Payoneer charges:

- Withdrawal fees: Payoneer charges a fee for withdrawing funds to your local bank account or ATM. The fee varies depending on the country and currency .

- Currency conversion fees: If you receive payments in a currency other than your receiving account currency, Payoneer will convert the funds to your receiving account currency at a competitive exchange rate . Payoneer charges a fee for this service, which varies depending on the currency pair and the amount of the transaction .

- Receiving fees: If you receive payments from certain marketplaces or companies, Payoneer may charge a receiving fee . The fee varies depending on the marketplace or company.

- Annual account maintenance fee: Payoneer charges an annual account maintenance fee of $29.95 .

What is the exchange rate used by Payoneer?

Payoneer uses competitive exchange rate to convert funds from one currency to another. The exchange rate is based on the mid-market rate with a single 0.5% fee This means that you can convert your funds at a fair and transparent rate, without worrying about hidden fees or unfavourable exchange rates.

Note that the exchange rate may vary depending on the currency pair and the amount of the transaction.

How to Sign Up for Payoneer

To sign up for Payoneer, you can visit their websites and click on the sign up button on the top right corner of the page.

You will be asked to provide your personal information, such as your name, email address, date of birth, and phone number.

You will also need to provide your business details, such as your name, type of business, and website if applicable. Once done, Payoneer will review your application and notify you via your email once your account is approved