Opening a USD bank account can be beneficial for people who frequently deal with USD transactions, such as travellers, expats, bloggers, freelancers and etc.

A USD account can help you save money on foreign exchange fees and provide you with a convenient way to manage your USD transactions.

What is a Payoneer USD Bank Account?

A Payoneer USD Bank Account is a service provided by Payoneer that allows you to receive payments in US dollars, as if you had a local bank account in the United States. This service is particularly useful for individuals and businesses located outside the US who need to conduct business with US customers or suppliers.

With a Payoneer account, you can get your own bank account details in Americas, Europe, Asia so you can get paid in popular currencies. One Payoneer account can provide multiple sets of account details for the currencies you get paid in. This makes it easier to accept the local currency in the US, the UK, Europe, Australia, China, Japan, and more.

For your client or marketplace, the local receiving account details provided by Payoneer act just like a bank account so you can give yourself a global presence and get paid. The money you earn with Payoneer’s receiving accounts will land in a currency balance in your Payoneer account without needing to be converted.

This service is great for getting paid by Amazon, Google Adsense, Upwork, Fiverr, Freelancer and other marketplaces that require local bank accounts to receive payments. If your client asks for a bank account to transfer your payment, you can give them your Payoneer receiving account details. They get an easy, local way to pay for your services and you get to collect the payment directly to your Payoneer account without the need for an international wire fee.

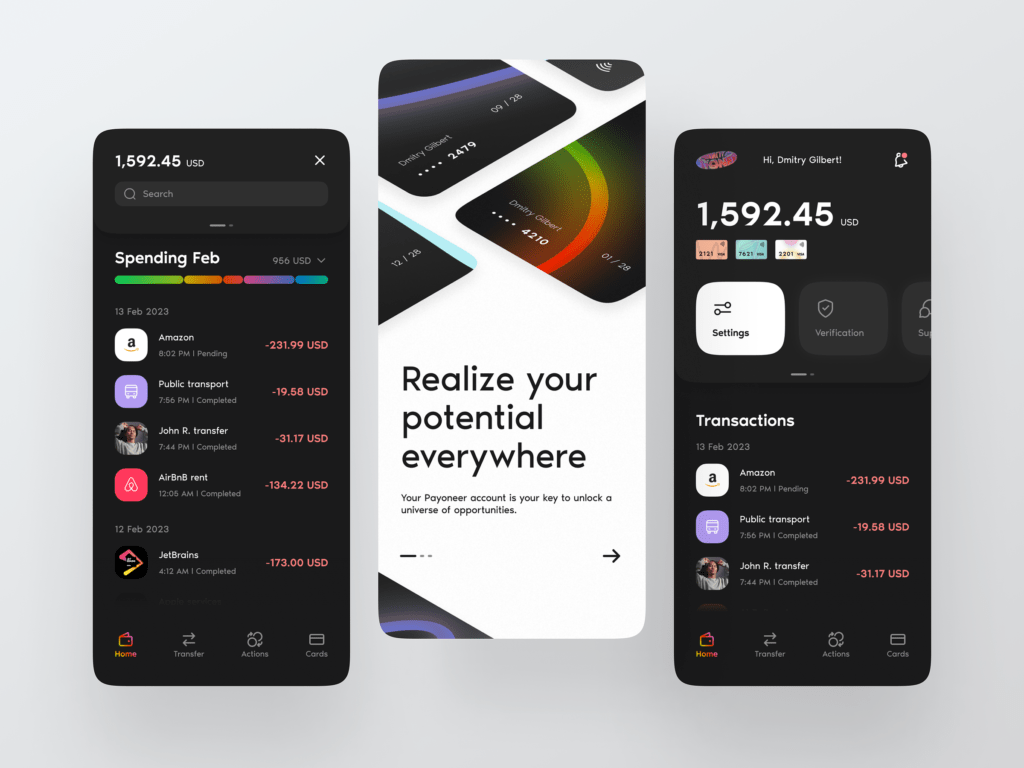

Benefits of having a Payoneer USD Bank Account in Africa.

Here’s a more detailed description of the benefits of having a Payoneer USD Bank Account in Africa:

- Global Transactions: Payoneer allows you to make payments in over 200 countries. This means you can send and receive money from businesses and professionals across the globe.

- Avoid Bank Charges: With Payoneer, you can avoid steep bank charges that are often associated with international transactions.

- Low-Cost Fee Structure: Payoneer offers a low-cost fee structure, which means it’s cheaper to send money internationally compared to many other platforms.

- No Administrative Hassles: Payoneer simplifies the process of managing your finances, eliminating administrative hassles.

- 24/7 Online Access: Payoneer provides 24/7 online access to your account, allowing you to check balances and transactions at any time.

- Multilingual Support: Payoneer offers in-house multilingual support via live chat, telephone, and email, making it easier for users who speak different languages to get the help they need.

- Fast International Payments: Payoneer’s platform allows for fast international payments, ensuring that you can send and receive money quickly.

- Transparent and Inexpensive Foreign Currency Conversions: Payoneer offers transparent and inexpensive foreign currency conversions, making it cost-effective to send money in different currencies.

- Convenient Local Bank Account in USD: With Payoneer, you can have a local bank account in USD. This makes it much easier to manage payments between your company and contractors, employees, suppliers, and customers in the US, no matter where you or your business are located.

- Receive Funds from Global Marketplaces: Payoneer allows you to receive funds from top global marketplaces in a fast, secure and cost-effective manner. The funds can be received in 200 countries and 150+ currencies, ending up in your local bank account.

- Master Card: Payoneer provides a MasterCard that you can use for online purchases, in-store purchases, or ATM withdrawals wherever MasterCard is accepted.

All these make Payoneer a convenient and efficient choice for managing international transactions.

How create a Payoneer USD account in Africa as an individual

- Go to the Payoneer website .

- Click on the “Sign Up” button.

- Select whether you want to sign up as an individual.

- Fill in your personal information, including your name, email address, date of birth, and phone number.

- Enter your address and select your country of residence.

- Choose a password for your account.

- Provide your bank account details to link your USD account with Payoneer .

- Verify your identity by providing a copy of your government-issued ID or passport .

Once done, you should receive an email Payoneer confirming that your account has been created.

How to create a Payoneer USD account as a business in Africa

- Go to the Payoneer website and click on the “Sign Up” button.

- Fill in your personal details, including your name, email address, and date of birth.

- Provide your contact information, including your phone number and address.

- Choose a password for your account and select a security question.

- Click on the “Submit” button to create your account.

- Once you have created your account, you can apply for a Payoneer USD Bank Account by following these steps:

- Sign in to your Payoneer account.

- Click on the “Receive” tab and select “Global Payment Service.”

- Choose the currency you want to receive payments in and click on the “Add” button.

- Follow the instructions to complete the application process.

A review takes around three business days. If all the information you provided is correct, you’ll get approved and you can start operating your Payoneer account.