Kuda, a prominent African neobank, has been making waves in the fintech industry. Recently, the company embarked on a significant funding endeavor, aiming to raise a substantial $20 million. This funding attempt carried immense importance for Kuda’s growth trajectory and strategic positioning within the African financial landscape. However, Kuda faced unexpected challenges in achieving its user milestone projection, falling short by a staggering 3 million users.

Kuda’s mission is to revolutionize banking in Africa by providing accessible, transparent, and user-friendly financial services. They aim to empower individuals and businesses, especially the unbanked and underbanked, with modern banking solutions.

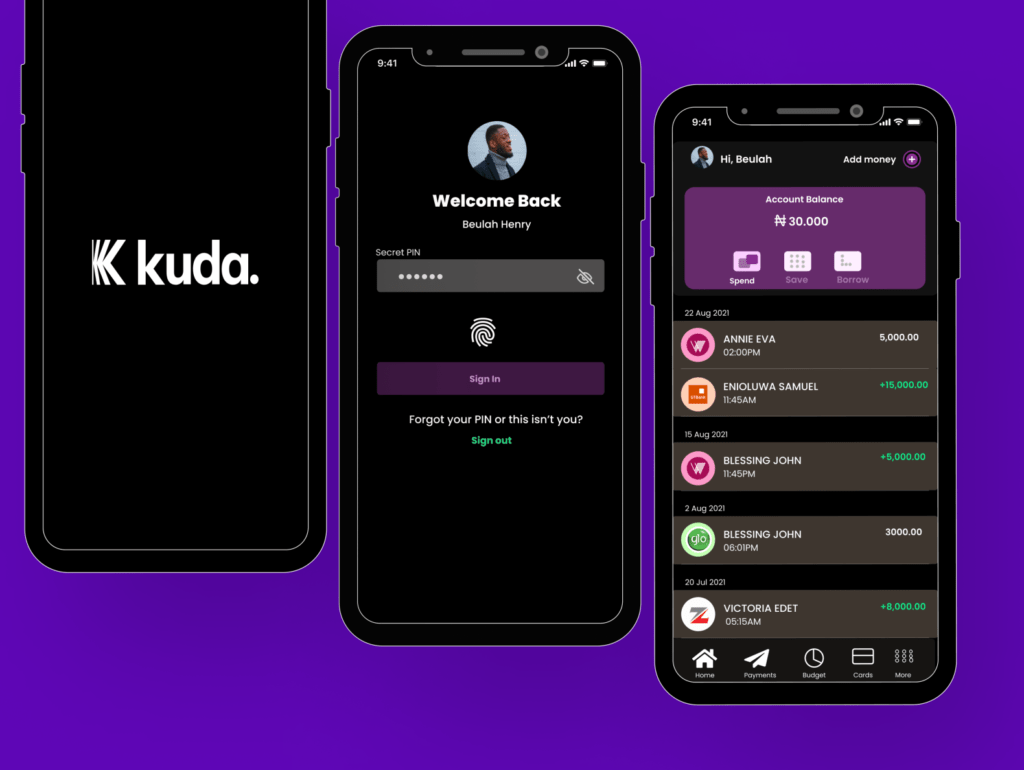

Their Services include Digital Banking. Kuda operates entirely online, allowing customers to manage their finances through a mobile app. Kuda prides itself on being fee-free for basic services like account maintenance, transfers, and card usage.

Users can save and invest directly within the app, promoting financial literacy and wealth-building. Kuda issues debit cards for seamless transactions. The app provides tools to track spending, set budgets, and achieve financial goals and emphasizes responsive customer service.

Kuda spent the majority of its 2021 budget on operating costs, which included hiring new employees, marketing, and brand recognition. However, in contrast to other international neobanks, Kuda also lost money due to a poorly designed lending product, the non-performing loan (NPL) percentage of which was 69% in the same year, much higher than the industry norm of less than 5%, according to the research.

Kuda has experienced rapid growth since its inception. It attracted significant attention from investors and venture capital firms. The recent funding attempt of $20 million was a pivotal moment in Kuda’s journey, reflecting its ambition to scale further. However, falling short of the user milestone projection by 3 million users highlights the challenges faced by fintech startups in a competitive market.

Why did Kuda need this capital?

The primary purpose was to fuel its growth, enhance its technological infrastructure, and expand its product offerings.

- Scaling Operations: Kuda aimed to scale its operations across Africa. To achieve this, it required additional resources for hiring, marketing, and customer acquisition.

- Product Development: Neobanks thrive on innovation. Kuda needed funds to develop new features, improve its app, and offer a seamless banking experience.

- Market Penetration: Africa’s financial landscape is diverse and competitive. Kuda needed capital to penetrate new markets, reach more users, and establish a strong foothold.

- Regulatory Compliance: Meeting regulatory requirements demands investment. Kuda needed funds to ensure compliance and maintain trust with regulators and customers.

- User Acquisition: Kuda’s user base was crucial. The $20 million would enable aggressive user acquisition strategies, aiming to onboard millions of customers.

- Infrastructure Investment: Building a robust banking platform requires substantial investment in technology, security, and scalability.

Kuda’s user Milestone Projection

Kuda set an ambitious goal to onboard a substantial number of users. Their initial target was to reach million users. Despite their efforts, Kuda fell short of their goal. The actual user base they achieved stood at half a million. Unfortunately, Kuda missed their target by a significant margin.

As of 2022, Kuda had a 25x revenue multiple at a $500 million valuation. With a 12.5x multiple, the fintech projected $40 million in revenue for 2023 per a report by Techcrunch. In response to whether Kuda’s sales target and other expectations were met, the fintech company said that it was “not permitted to share those numbers until an audit has been done and approval given by the regulator” and declined to comment more.

Challenges Kuda faced and impact on their growth plans and investors

The African fintech landscape was highly competitive. Kuda faced challenges in a competitive fintech landscape, including market penetration, regulatory compliance, and user adoption. Another challenge was stiff competition from other neobanks, traditional banks, and mobile money services.

They underestimated the time it takes for users to adopt new financial technologies. Kuda needed robust infrastructure to serve users seamlessly, especially in remote or underserved locations. Kuda’s growth trajectory needed recalibration. Rapid user acquisition strains operational capacity hence leading to scalability issues.

Nevertheless, Kuda’s short-term problem is convincing investors that its unit economics support its expansion goals. As the self-described “money app for Africans,” Kuda needs to demonstrate, before expanding farther, that a VC-backed neobank can succeed on the continent, just as Brazil’s Nubank did in Latin America.