The U.S. Securities and Exchange Commission (SEC) has imposed a substantial financial penalty on Dozy Mmobuosi, the Chief Executive Officer of Tingo. The federal court has directed Mmobuosi to pay over $250 million in fines. Additionally, he has been prohibited from serving as a director of any public company.

This decision follows a significant legal action taken against Mmobuosi and his companies for fraudulent activities. Dozy Mmobuosi, a Nigerian businessman, and three companies he leads were charged by the U.S. Securities and Exchange Commission (SEC) on 2023. The SEC claims that Mmobuosi and his associates falsified the financial statements of the firms and its major subsidiaries in order to deceive investors.

Fraudulent Financial Practices Uncovered

In 2023, the SEC charged Mmobuosi and three of his companies—Tingo Group, Agri-Fintech Holdings, and Tingo International Holdings—with fraud. The charges stemmed from allegations that they had misrepresented the financial performance of their enterprises and key operating subsidiaries. Specifically, the SEC found that Tingo Group falsely reported a cash and cash equivalent balance of $461.7 million for its subsidiary, Tingo Mobile, in its 2022 fiscal year Form 10-K filed in March 2023. However, the actual balance in the Nigerian bank accounts of Tingo Mobile was less than $50 at the end of the fiscal year 2022.

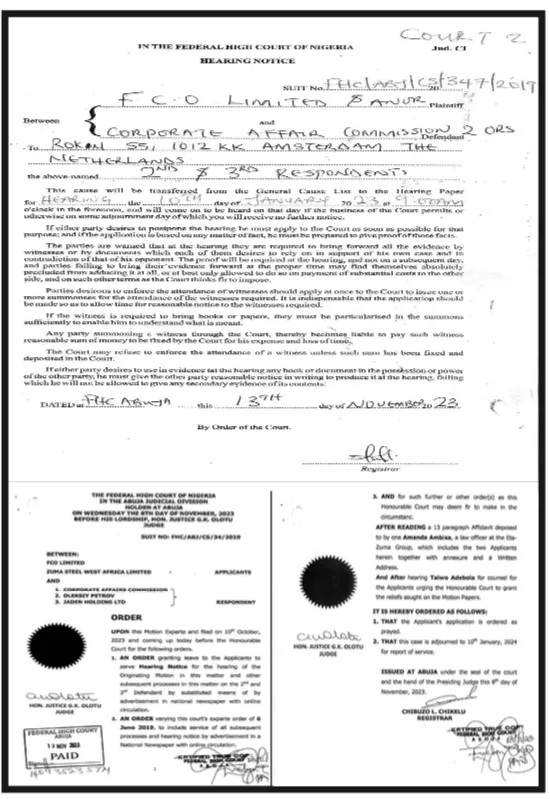

Court Proceedings and Final Judgment

Judge Jesse M. Furman of the U.S. District Court for the Southern District of New York has finalized the judgment against Mmobuosi and his companies. The judgment was entered by default after Mmobuosi failed to respond to the civil complaint filed by the SEC. The court noted that Mmobuosi and his entities did not answer, plead, or otherwise defend themselves in the case.

Implications of the Verdict

The court’s ruling mandates that Mmobuosi and his associated companies are now subject to significant financial penalties and restrictions. The judgment also bars them from violating key anti-fraud provisions of federal securities laws, including Section 17(a) of the Securities Act of 1933, Section 10(b) of the Securities Exchange Act of 1934, and Rule 10b-5. This action underscores the SEC’s commitment to holding corporate executives accountable for financial misconduct and protecting investors from fraudulent practices.

This landmark decision serves as a powerful reminder of the legal consequences that can arise from fraudulent activities in the financial sector. The SEC’s enforcement action against Dozy Mmobuosi highlights the regulatory body’s vigilance in maintaining the integrity of the financial markets and ensuring that public company directors adhere to the highest standards of transparency and honesty.